Get a free consultation now!

U.S. Tariff Update May 2, 2025: Costs, Exceptions, and Strategies for Businesses

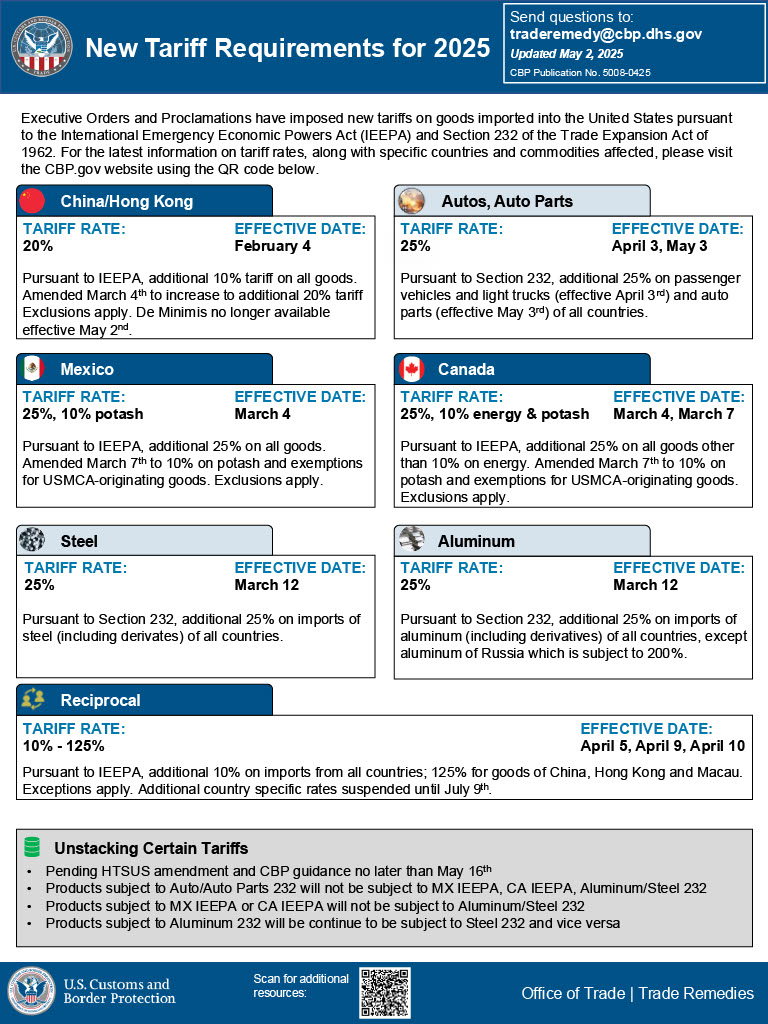

In May 2025, U.S. Customs and Border Protection (CBP) released a new fact sheet outlining sweeping tariff increases under the International Emergency Economic Powers Act (IEEPA) and Section 232 (national security-based tariffs).

For small and mid-sized businesses that rely on international suppliers, these changes pose challenges to landed costs, supply chain operations, and cash flow. Express Trade Capital helps B2B importers navigate this shifting landscape with flexible financing, logistics coordination, and compliance support, ensuring you can meet customer demand, maintain liquidity, and stay compliant in a rapidly evolving trade environment.

Chart released by U.S. Customs and Border Protection on May 2, 2025

What’s Changing – Key Tariffs and Effective Dates

The 2025 U.S. tariff changes fall under two main authorities: IEEPA and Section 232. These are broad measures imposed by executive action, targeting specific countries, and in some cases, nearly all imports including additional duties. The table below outlines key tariff requirements by country and sector, including rates, effective dates, and legal authority. Use it to stay informed and plan your import strategy accordingly.

Tariff Comparison Table

| Country/Sector | Tariff Rate | Effective Dates & Amendments | Legal Authority | Notes |

|---|---|---|---|---|

| China / Hong Kong / Macau | 125% | April 10: 125% May 2: De Minimis removed |

IEEPA | Highest tariff on record for these regions; affects all goods. |

| Mexico | 25%, 10% potash | Mar 4: Base 25% imposed Mar 7: Added 10% on potash, USMCA exclusions |

IEEPA | Exemptions for USMCA-origin goods; potash now explicitly targeted. |

| Canada | 25%, 10% energy & potash | Mar 4: 25% tariffs imposed, 10% on energy Mar 7: 10% on potash, USMCA exclusions |

IEEPA | USMCA-origin goods exempted; energy and potash receive extra duties. |

| Autos & Auto Parts | 25% | Apr 3: Passenger vehicles & light trucks May 3: Auto parts |

Section 232 | Applies to all countries; based on national security policy. |

| Steel | 25% | Mar 12: Tariff imposed on steel and derivatives | Section 232 | Broad-based; includes all countries. |

| Aluminum | 25% (200% for Russia) | Mar 12: Tariff imposed on aluminum and derivatives | Section 232 | All aluminum imports taxed; Russia faces extreme 200% rate. |

| Reciprocal | 10% – 125% |

Apr 5: 10% global Apr 9: 125% China / Hong Kong / Macau Apr 10: Full rollout |

IEEPA | 125% applies to China / Hong Kong / Macau; others at 10% until July 9, 2025 |

Tariff Exceptions, Exemptions & Unstacking Rules: What Businesses Need to Know

USMCA-Originating Goods

USMCA-originating goods are products that qualify for duty-free or preferential treatment under the United States-Mexico-Canada Agreement (USMCA), the trade deal that replaced NAFTA in 2020.

What Makes a Product “USMCA-Originating”?

To be considered “originating,” a good must meet rules of origin defined in the agreement. This usually means:

- Wholly Obtained or Produced in the U.S., Mexico, or Canada

(e.g., minerals mined, crops grown, or animals born and raised in one of the three countries). - Made Entirely from Originating Materials

(e.g., a product assembled in Mexico using only U.S.- and Canadian-made parts). - Substantial Transformation + Regional Value Content (RVC)

- If foreign materials are used, the item must undergo a transformation in North America that meets specific criteria.

- Often, a minimum % of North American content is required.

Under the 2025 tariff changes:

- USMCA-originating goods may be exempt from certain IEEPA tariffs applied to Mexico and Canada.

- However, importers must prove origin (e.g., with a certificate of origin), and some other tariffs like Section 232 (steel, autos) may still apply.

De Minimis Rule

The De Minimis rule allows low-value shipments (typically under $800) to enter the U.S. duty-free, with minimal paperwork. It’s commonly used by e-commerce retailers, drop shippers, and small parcel carriers.

2025 Changes to the De Minimis Rule:

- Effect May 2, 2025 shipments from China, Hong Kong, and Macau are no longer eligible for De Minimis entry.

- Now shipments under $800 incur full duties and documentation.

No Duty Drawback on Reciprocal Tariffs

Under the 2025 U.S. tariff changes, duties paid under the new reciprocal tariffs (including the 10% base and 125% on China/Hong Kong/Macau) are not eligible for duty drawback.

Explanation of Unstacking Certain Tariffs (Released May 2, 2025 by UCB)

| Original Language | What It Means for Businesses |

|---|---|

| Pending HTSUS amendment and CBP guidance no later than May 16 | CBP will release final instructions by May 16, 2025 explaining which tariffs can be stacked (applied together) and which ones won’t be. |

| Products subject to Auto/Auto Parts 232 will not be subject to MX IEEPA, CA IEEPA, Aluminum/Steel 232 | If your imports are already hit with a 25% tariff for autos or parts under Section 232, you won’t pay additional tariffs under Mexico/Canada IEEPA or on aluminum/steel. |

| Products subject to MX IEEPA or CA IEEPA will not be subject to Aluminum/Steel 232 | If your goods from Mexico or Canada are already being taxed under IEEPA, you won’t be double-taxed with aluminum or steel tariffs too. |

| Products subject to Aluminum 232 will be continue to be subject to Steel 232 and vice versa | Aluminum and steel tariffs can still be stacked. If your product includes both metals, you’ll pay both tariffs (25% + 25%). |

Expanded HTSUS Guidance by May 16

CBP (U.S. Customs and Border Protection) will issue updated guidance by May 16, 2025, to clarify how the new tariffs interact with the Harmonized Tariff Schedule of the United States (HTSUS).

- This guidance will explain how and when tariffs are applied, especially for goods that may fall under multiple programs (e.g., IEEPA, Section 232, reciprocal tariffs).

- It will also outline unstacking rules, final product classifications, and any required HTSUS amendments.

- Importers should delay reclassifying goods or making tariff mitigation changes until this guidance is released.

While the new tariffs cast a wide net, knowing the exceptions can save you money. Make sure to leverage USMCA when you can, and be aware that sending multiple small packages (under $800 each) won’t work anymore. Every importer should double-check their supply chain for any opportunities to qualify for exemptions or to restructure shipments in light of these rules.

How These Tariffs Impact Importers

- Higher Landed Costs: Expect significant increases in the total cost of imported goods. A 125% tariff can more than double your landed cost, potentially making formerly profitable products unviable.

- Supply Chain Shifts: Importers reliant on China or other high-tariff countries will need to explore alternative suppliers, especially in Southeast Asia, India, or North America.

- Financing and Cash Flow Strain: Higher upfront duty payments can stress working capital. This may necessitate additional financing, trade credit solutions, or delayed inventory restocking.

- Compliance Complexity: Importers must now juggle multiple tariff programs, rules of origin, and classification codes. Documentation errors can lead to costly penalties and delays.

- Market and Strategy Changes: Some companies may exit unprofitable product lines, while others may invest in reshoring or nearshoring. Retailers and wholesalers must re-evaluate vendor relationships based on tariff-adjusted pricing

Importers must be proactive in responding to these changes. The cost and sourcing landscape has changed. Those who adapt quickly, whether by finding tariff workarounds, new suppliers, or by passing costs appropriately will better weather the storm than those who carry on “business as usual.”

Express Trade Capital Can Help Importers Navigate These Changes with Confidence

Adapting to the new tariff landscape can be daunting, but you don’t have to do it alone. Express Trade Capital specializes in exactly these kinds of trade challenges, offering a range of services to support importers with customs brokerage, trade compliance, and supply chain strategy.

Flexible Financing to Offset Tariff Costs

Our factoring program provides immediate liquidity by advancing funds on receivables, enabling importers to manage increased duties, freight charges, and supplier terms without waiting 30–90 days for payment.

End-to-End Logistics and Compliance Support

Our supply chain management services are built to help importers adapt to fast-changing conditions, reduce delays, and streamline operations across borders.

Conclusion: Stay Informed, Stay Competitive

The 2025 U.S. tariff changes are reshaping global trade for American importers. As a small or mid-sized business having the right planning, partners, and compliance tools, will help you stay competitive, agile, and informed. Now is the time to audit your supply chain, assess your exposure, and take action.

If you have questions about how these tariffs specifically impact your business or want to develop a customized plan to deal with them, reach out to us at Express Trade Capital. Our team is ready to help businesses like you navigate trade compliance challenges, optimize your supply chain strategy, and ensure healthy cashflow. Contact us for personalized guidance. We’ll partner with you to keep your goods flowing and your costs under control, turning a tough trade environment into an opportunity for smart, strategic growth.