Get a free consultation now!

Elevate Your Cross-Border Transactions with ETC’s Trade Finance Expertise

Embark on secure deals and unlock the potential of trade finance with ETC for seamless cross-border sales and purchases. With a rich legacy spanning decades, ETC has been a trusted ally, leveraging well-established bank facilities to facilitate transactional financing and mitigate risks for all involved parties.

A standout in our array of services, Letters of Credit (LC) empowers clients with creditworthy transactions to initiate production without burdensome deposits or impact on existing finance facilities. The LC Advantage lies in its ability to enable clients to commence production without tying up valuable collateral. This mutually beneficial arrangement ensures that buyers receive goods produced and delivered as expected, while sellers gain the means to secure their financing, guarded against the risk of releasing goods without payment.

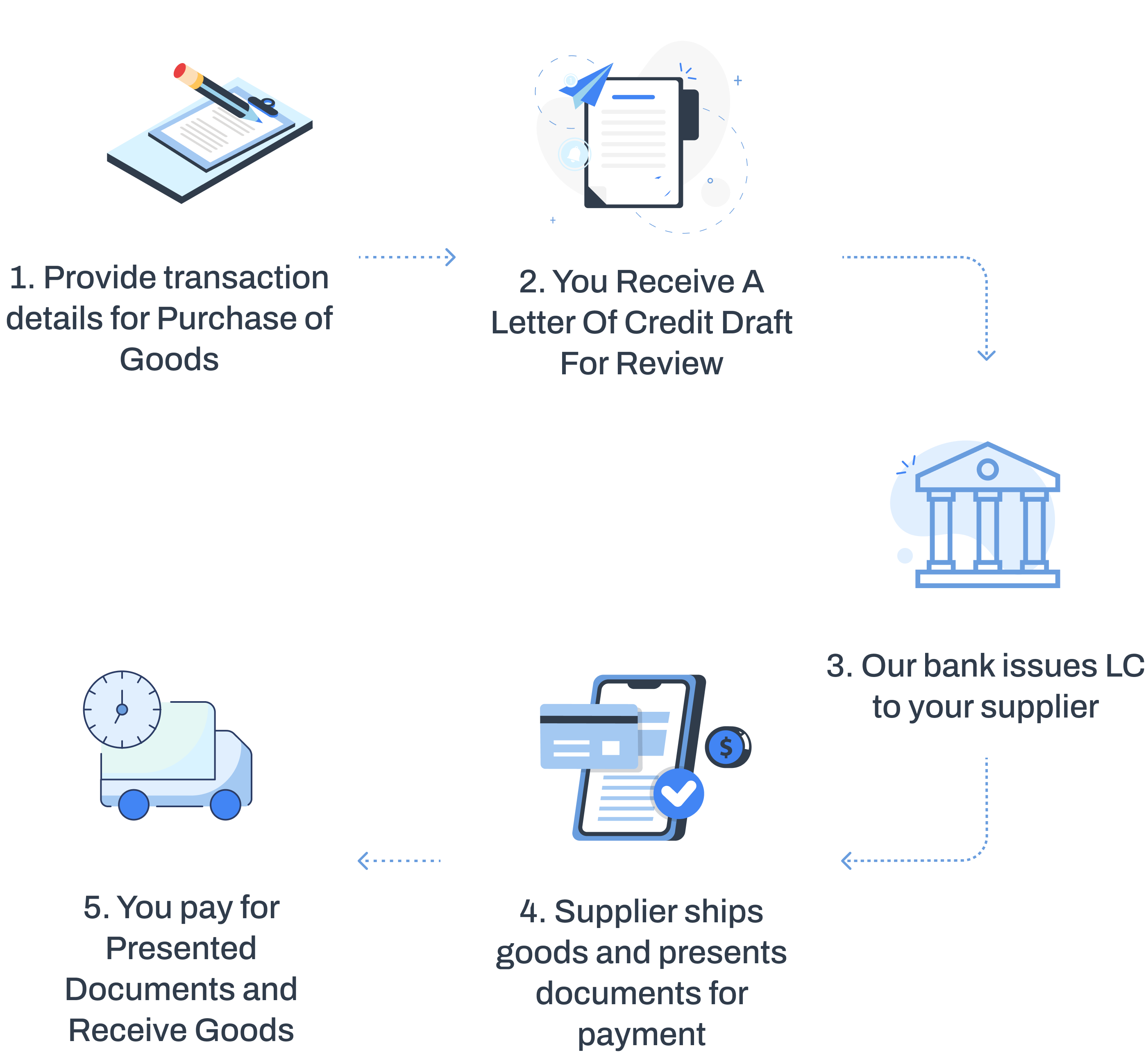

How Letters of Credit Work

-

Establish Terms

Collaborate with us to draft a Letter of Credit, tailored to align with the specific requirements of your transaction.

-

Seller's Assurance

Upon approval and issuance, the supplier receives a Letter of Credit, serving as a payment guarantee from a creditworthy bank, contingent upon meeting all stipulated terms.

-

Transaction Security

As the buyer, rest assured that your payment is only released after your supplier fulfills all agreed-upon terms and conditions, including timely delivery.

-

Flexibility and Customization

Our services are designed to accommodate diverse transactions, offering various forms of Letters of Credit and banking instruments to suit your unique needs.

In essence, our trade finance services add layers of security to your transactions, mitigate risks, facilitate cash flow, and foster trust with your trading partners. Elevate your cross-border dealings by reaching out to us. Contact us now to explore how we can contribute to the success of your international transactions!

Our Trade Finance Process